Demetrious Johnson suggests having more weight classes in MMA

Weight cutting is perennially one of the hottest topics of debate within the MMA community,…

Weight cutting is perennially one of the hottest topics of debate within the MMA community,…

Dr. Alex Sielatycki, right, of the Steamboat Orthopedic and Spine Institute is joined in the…

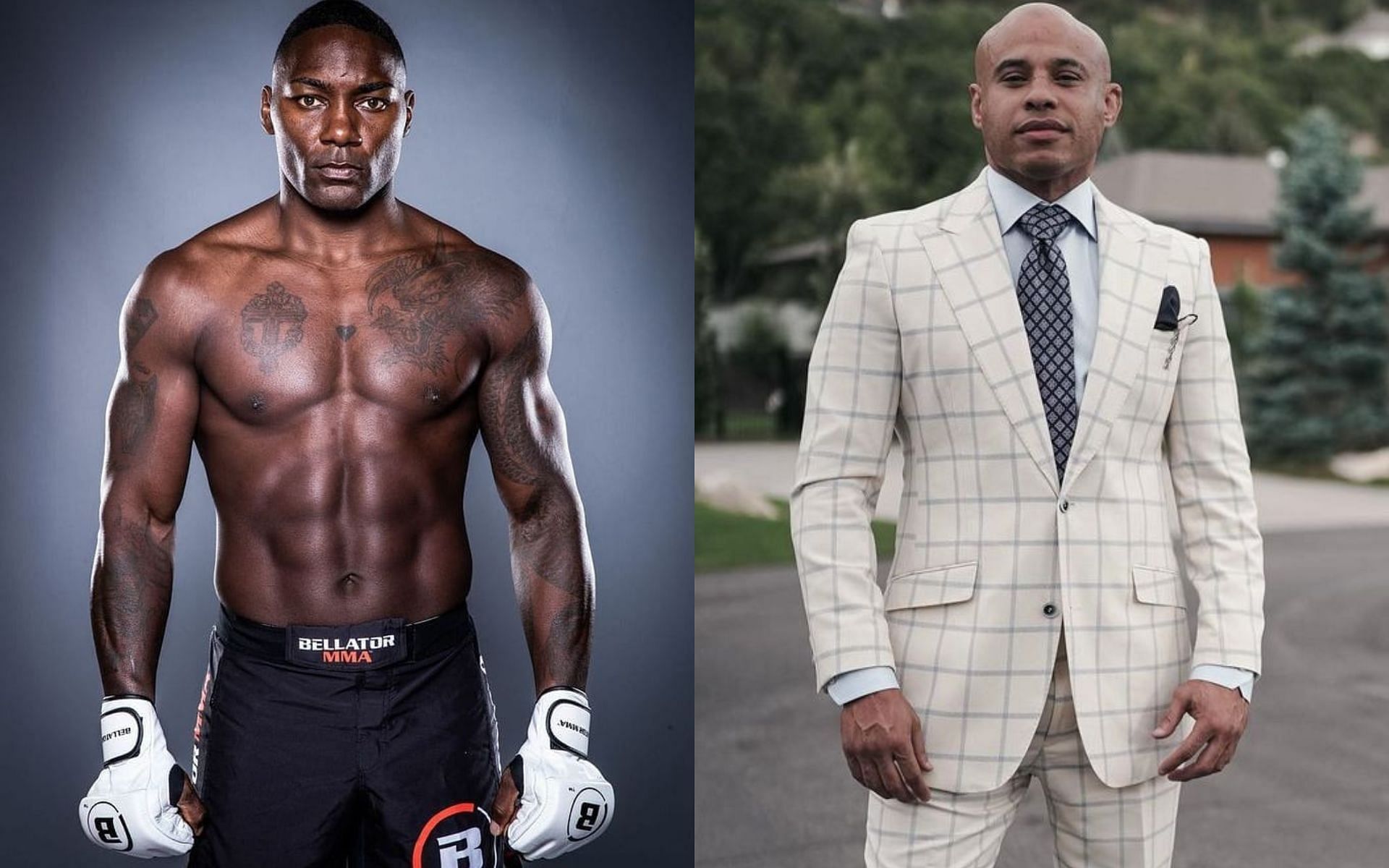

[ad_1] In a recent interview with ESPN-MMA’s Brett Okamoto, Anthony Johnson’s manager, Ali Abdelaziz, shared…

[ad_1] Bellator MMA’s heavyweight division has a new addition.On Wednesday, the California-based promotion announced the…

Miami: Fight Scout® App is delighted to announce partnership agreements with Goat Shed Academy, based…

[ad_1] Verbal agreements are in place for a welterweight matchup between Daniel Rodriguez and Neil…

[ad_1]What is the biggest high school wrestling event in this country every year? Fargo? U17…

The Jake Paul vs. Anderson Silva boxing undercard will feature an unorthodox matchup.UFC and Bellator…

[ad_1] Tamyra Mensah Stock celebrates winning the women’s 68kg freestyle event. title fight at the…

Brittney Palmer is one of the most recognizable UFC Octagon Girls in the world. She…

[ad_1] Former Iowa City West and Iowa Hawkeye State Champion Dylan Carew looks on during…

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/tronc/FVL4Z53AN5FKRGSSCWBKXOGQPM.jpg)

[ad_1]The upcoming 2022 World Junior Wrestling Championships in Sofia, Bulgaria will have a Maryland tinge.Jaxon…

[ad_1]Trash-talk has become an important part of modern fighting. The more a fighter can hype…

[ad_1] Andre Petroski easily submitted Nick Maximov at a UFC event on Saturday in Las…

[ad_1] Several high-profile matches may have just been inadvertently leaked by the UFC when their…

[ad_1]Former Oklahoma Sooner Dom Demas entered the transfer portal in early February and took to…

[ad_1] Brendan Schaub recently gave fans a look at the start of the Jake Paul…

[ad_1] Getty Images The UFC continues to deliver on its promise of action fighting. The…

Some changes to the A championship the list dwindled over the weekend. The organization has…

[ad_1] An all-inclusive wrestling club has come to Coffee County, while nurturing the surrounding area…

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/TIR3VXS2A2BVB6ASTWNAHINT6Y.jpg)

[ad_1]The inaugural event for the new Global Titans Fight series will take place next month…

[ad_1] Sebastien Rubino / [email protected] Battle Ground High School held a wrestling tournament on April…

.jpg)

[ad_1] Very few fighters actually enter the cfu with another goal than to earn the…

[ad_1] UFC 226 was a real high point in the heavyweight division and it became…

[ad_1] Veteran MMA fighter Quinton “Rampage” Jackson credits Jake Paul with bringing boxing back to…

[ad_1]After one of the most successful and exciting years in UFC history, the mixed martial…

The long-awaited mixed martial arts debut of amateur wrestler Pat Downey will have to wait.…

[ad_1] UFC 273 is stacked with a pair of title fights and one of MMA’s…

[ad_1] The upcoming Triad Combat 2 event scheduled to take place February 26 live on…

-2.jpg)

[ad_1] Valentina Shevchenko is one of the most dominant female champions in MMA history. With…

[ad_1]UFC legend Rashad Evans is a former champion and an audience favorite. However, the fighter…

[ad_1] Less than a month after Julian Lane and Mike Perry brawled outside the ring…

[ad_1] Nate Diaz has given the world of combat sports several memorable moments over the…

[ad_1]Former UFC welterweight title challenger Darren Till will soon be returning to action to title…

[ad_1] Olympic gold medalist Gable Steveson has yet to work for WWE, but he’s already…

Join the leaders of online gaming at GamesBeat Summit Next on November 9-10. Learn more…

[ad_1] VSN (admin) Posted on Friday, October 15, 2021 – 2:30 PM St. Louis University…

[ad_1] To share Tweeter To share To share E-mail A San Diego native and half…

There are a lot of questions about Payday Loans. We’ll attempt to address a number of…

90 Day Fiancé: Before the 90 Days, Yolanda Leak’s new boyfriend, John, isn’t a catfish…

[ad_1] Urijah Faber took to Instagram to post a meme video that showcased all the…

[ad_1]So many times I prayed that this day would not come. And there are no…

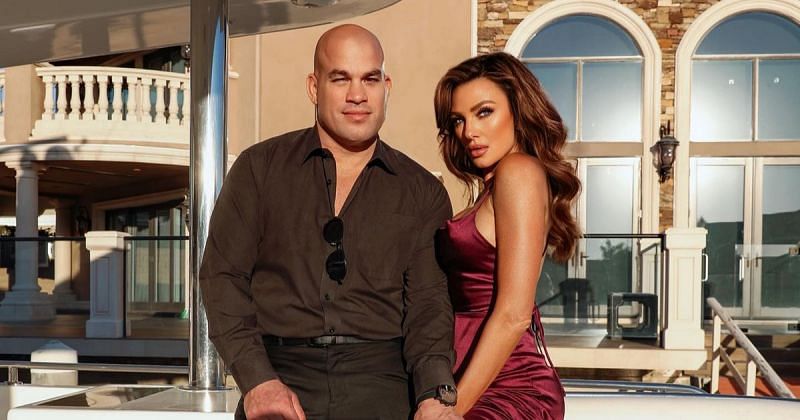

[ad_1] Amber Nichole Miller is the companion and fiancee of Tito Ortiz. She was also…

[ad_1] Sean gannon Sean Gannon, a UFC veteran who became the first man to beat…